Making Tax Digital for Income Tax Self-Assessment (MTD for ITSA)

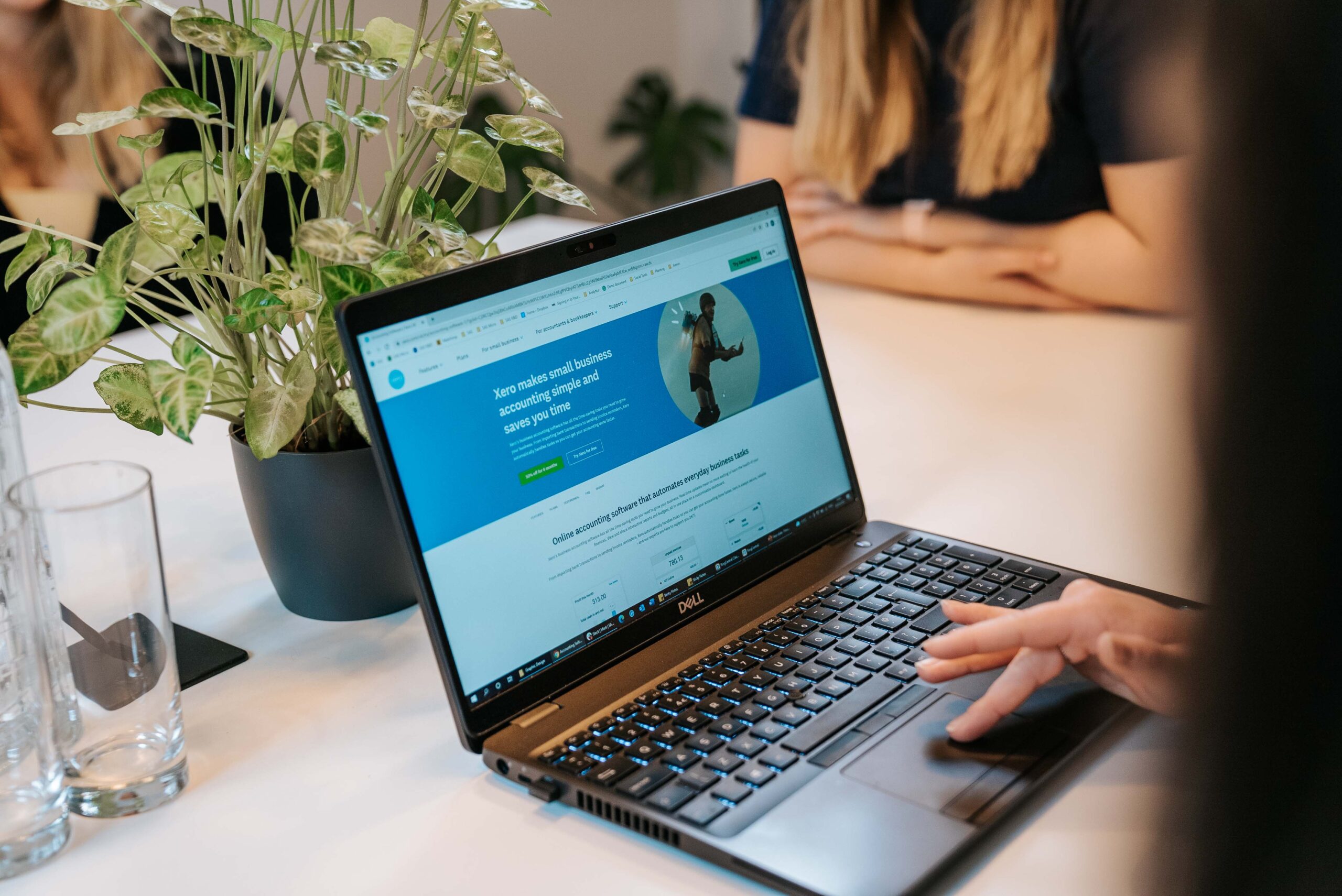

What is MTD for ITSA? Making Tax Digital for Income Tax Self Assessment (MTD for ITSA) is a new way for self-employed business owners and landlords to report earnings and pay Income Tax. MTD for ITSA will apply to individuals from April 2024, if their total gross income from self-employment and property exceeds £10,000 in a tax year. … Read more