It’s that time of year, no not Halloween or Christmas… it’s the Autumn Budget!

We’re detailing the key changes and how they affect you. But of course, if you have any questions let us know.

You may have seen our Twitter updates on some of the key changes.

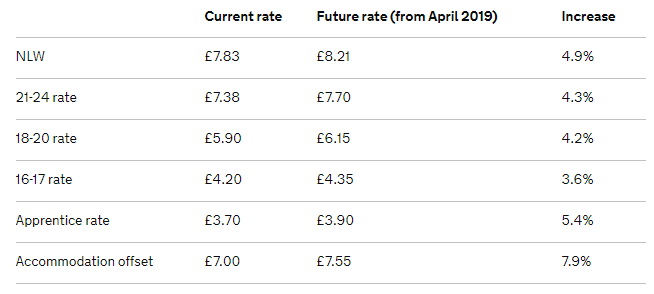

- Minimum Wage (currently £7.83) will increase to £8.21 per hour for those aged over 25.

- Your Personal Allowance is the amount you earn tax-free and it is increasing (from £11,850) up to £12,500 from April 2019.

- Road users, Fuel Duty has been frozen for the ninth year in a row. Local councils in England will receive an additional £420m to tackle #potholes.

- For those drinkers, duty on beer and cider has been frozen. Although there will be an increase to wine and some ‘high-strength’ drinks.

- Bad news for any smokers, Tobacco Duty will continue to rise by inflation, plus 2%.

- First-time buyers who purchase via a shared ownership scheme will no longer have to pay stamp duty for homes up to the value of £500k. In addition, it will be backdated for anyone who has purchased within the last year!

- To announce our departure from the European Union, a commemorative 50p coin will be issued. The coin will feature the Queen’s head and the date 29 March 2019 and on the reverse the phrase “Friendship with all nations”.

- Your basic rate band is the amount you earn where you will be subject to 20% income tax. This amount is increasing (meaning you take more home at 20% and less at higher rate of 40%) from £34,500 up to £37,500 from Apr-2019. This is not including your personal allowance!

- Entrepreneurs Relief minimum holding period increased to 2 years (from 1 year) for disposals after 5th April 2019

- Capital Gains Tax Exemption increased to £12,000 (from £11,700) for the 2019-20 tax year

- Annual Investment Allowance to be increased to £1m (from £200k) for a 2-year period starting 1st January 2019

- Research & Development Tax Relief for loss making SME’s capped at 3x total PAYE and NI liability from April 2020. Speak to our specialist R&D department for more info! ?

- Private Residence Relief Exemption for final period of ownership reduced to 9 months (from 18 months) from April 2020

- Dividend Tax Allowance maintained at £2,000 for the 2019-20 tax year. This is the amount if dividends you can receive tax-free.